EC & AI Commerce News Digest (January 28, 2026)

Akihiro Suzuki

Twitter

Source: www.channelnewsasia.com

Key Takeaways

- Amazon closes all Go/Fresh stores, pivots to Whole Foods expansion

- UPS cuts 30,000 jobs as Amazon shipping volume reduction impacts logistics industry

- Mastercard launches Agent Suite, expanding agentic commerce infrastructure

Today's Top News

Amazon to Close All Amazon Go and Amazon Fresh Stores

Amazon is closing its physical Amazon Go and Amazon Fresh stores

Upon closing down some stores in 2024, an Amazon spokesperson said that the company 'couldn't make the economics work with the lease cost.' These retail closures will not impact customers who use Amazon for grocery delivery.

On January 27, Amazon announced it will close all Amazon Go and Amazon Fresh stores, instead focusing on expanding Whole Foods Market and enhancing same-day delivery services.

Amazon Go launched in 2016 as a "checkout-free store" and attracted attention as an experimental venue for "Just Walk Out" technology. However, the company explained that "while there were promising signs in Amazon-branded physical stores, we haven't yet built the unique customer experience and appropriate economic model needed for large-scale deployment."

Going forward, the company plans to open over 100 new Whole Foods stores over the coming years and will also expand the smaller format "Whole Foods Market Daily Shop." Just Walk Out technology will focus on third-party facilities in over 360 locations across 5 countries (such as sports stadiums). Since the 2017 Whole Foods acquisition, sales have grown over 40% to 550 stores, making the decision to concentrate resources on the well-recognized Whole Foods brand understandable.

This decision represents a major shift in physical retail strategy by the e-commerce giant and raises significant questions for the industry about the future of unmanned store technology.

Full article: Amazon to Close All Amazon Go and Amazon Fresh Stores

UPS Announces Additional 30,000 Job Cuts, Impacted by Amazon Shipping Reduction

UPS to cut up to 30000 jobs in move away from Amazon

UPS announced it will cut up to 30,000 operational jobs in 2026 as part of its transformation strategy.

In its Q4 earnings announcement on January 27, UPS announced it will cut up to 30,000 operational jobs and close 24 facilities in 2026. This follows last year's reduction of 48,000 jobs in another large-scale restructuring.

Behind this is the reduction in business with its largest customer, Amazon. In January 2025, UPS signed an agreement to reduce Amazon shipping volume by more than 50% by late 2026. CEO Carol Tomé stated, "We will reduce Amazon's daily shipping volume by about 1 million packages by the end of 2025, and another 1 million in 2026." The company described its Amazon business as "extraordinarily dilutive to margins."

UPS is pursuing a strategy of shifting to higher-margin shipments, projecting $89.7 billion in revenue for 2026. Balancing intensifying e-commerce logistics competition with margin preservation has become a challenge for the entire logistics industry.

Agentic Commerce

Mastercard Launches "Agent Suite" for Merchants

Mastercard launches Agent Suite for AI commerce

Mastercard announces Agent Suite to help merchants prepare for agentic commerce era.

Mastercard announced "Agent Suite," a new solution to help merchants and banks adapt to the AI agent era. It is scheduled to launch in Q2 2026.

Agent Suite differs from the "Agent Pay" payment authentication framework announced in January—it's a customer experience building platform for merchants. It allows setting rules for inventory, margins, promotions, and brand voice, providing conversational guidance throughout the shopping journey.

Initial use cases include product discovery features for banks and personalization combined with conversational shopping for merchants. It will also integrate with Google UCP, Microsoft Copilot Checkout, and OpenAI Agentic Commerce Protocol, advancing the agentic commerce ecosystem.

Full article: Mastercard Launches "Agent Suite" for Agentic Commerce

HawkSearch and Nexi Group Join Agentic Commerce Alliance

HawkSearch Joins Agentic Commerce Alliance

HawkSearch announces membership in the Agentic Commerce Alliance to shape the future of AI-driven commerce.

Two new companies have joined the "Agentic Commerce Alliance (ACA)," which aims to standardize commerce by AI agents.

HawkSearch, a subsidiary of Bridgeline Digital, will contribute its expertise in product discovery and merchandising intelligence as an AI-driven search and personalization platform. CEO Ari Kahn stated, "As we move toward a future where AI agents play an active role in discovery, decision-making, and transactions, we're committed to ensuring these agents operate transparently and in ways that benefit both merchants and shoppers."

European payment giant Nexi Group has also joined the alliance. The company has been working on agentic commerce initiatives with Google, Mastercard, and Visa, contributing its European-scale local payment knowledge and experience protecting transaction layers for AI agents.

ACA is led by Shopware and aims to enable AI agents to operate interoperably across platforms while respecting merchant control through vendor-neutral open standard development.

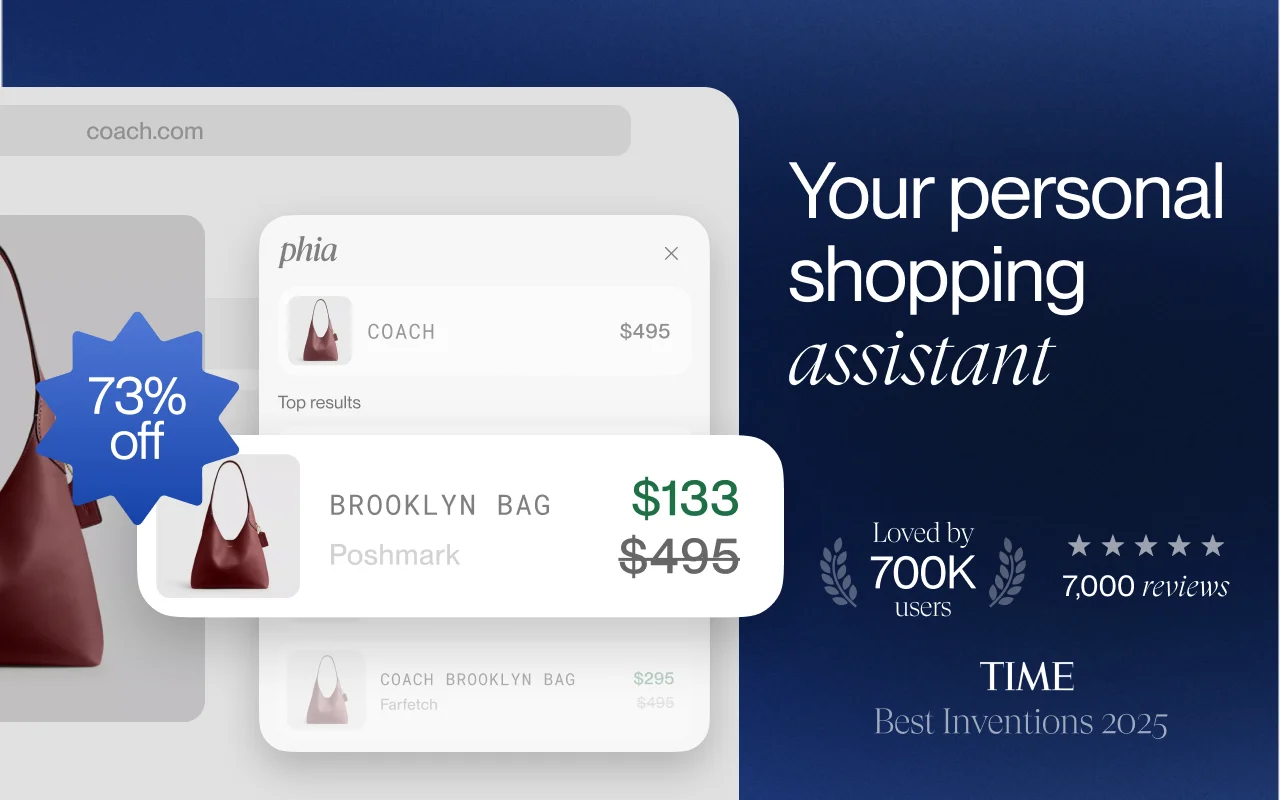

Phia Raises $35M for AI Shopping Agent Development

Phia Raises $35M Series A to Build the AI Alignment Layer for Commerce

Phia closes $35M Series A at $185M valuation to build the AI alignment layer between brands and consumers.

"Phia," an AI shopping agent co-founded by Phoebe Gates and Sophia Kianni, has raised $35 million in Series A funding. The valuation stands at $185 million.

In just 10 months since its April 2025 launch, the company has acquired over 1 million users and 6,200+ retail partners, achieving 11x revenue growth. Notable Capital led the round, with Khosla Ventures and Kleiner Perkins also participating.

Phia processes billions of products daily, providing personalized product recommendations. It has reduced search latency by 80% and increased monetizable GMV by 40%. For brands, the company reports 13% improvement in conversion rates, 30% increase in new customer acquisition, and over 50% reduction in return rates.

Full article: Phia: The AI Shopping Agent Founded by Bill Gates' Daughter Raises $35 Million

Global EC Trends

Latin American E-Commerce Market Accelerates with Rapid Delivery Demand

Latin American e-commerce to top $215 billion

Consumer demand for rapid delivery drives Latin American e-commerce growth.

According to a report from Americas Market Intelligence (AMI), the Latin American e-commerce market continues to grow driven by consumer demand for rapid delivery.

PCMI forecasts that the region's e-commerce transaction volume will reach $923 billion by the end of 2026, doubling from 2022 to 2026. The compound annual growth rate of 23% represents rare high growth globally. Brazil and Mexico lead the market, with Colombia, Peru, and Argentina also experiencing rapid growth.

As consumer expectations for same-day and next-day delivery increase, investment in logistics infrastructure is becoming a key factor determining companies' competitiveness.

China Strengthens E-Commerce Price Competition Regulations

China's new online rules mean for brands

China introduces new regulations targeting platform competition and pricing practices.

In January, the Chinese government announced regulations prohibiting major platforms like Alibaba from forcing merchants to participate in promotions. These take effect in February.

Additionally, in April, 29 new regulations will take effect that prohibit platforms from forcing "minimum price" contracts on merchants or conducting user data-based pricing without consent. Traffic restrictions, search ranking demotions, and algorithmic penalties used to pressure price reductions are also prohibited.

These regulations address issues where fierce price competition between platforms has infringed on merchants' operational autonomy. Brands have been forced to "create similar products with different model numbers for each platform," increasing operational costs. Brands operating in the Chinese market need to adapt to these regulatory changes.

Summary

Today brought two major news stories symbolizing structural changes in the e-commerce and logistics industries: Amazon's major pivot in physical retail strategy and UPS's large-scale restructuring. Amazon is shifting focus from unmanned store technology investment to Whole Foods and delivery, while UPS is accelerating its departure from Amazon dependency toward higher-margin business.

In the agentic commerce space, companies joining the Agentic Commerce Alliance continue to grow, accelerating industry standardization efforts. As Phia's large funding round demonstrates, investment in AI shopping agents is intensifying, and 2026 is shaping up to be the year when competition in this space truly heats up.

Going forward, watch for how Amazon's store closures affect Just Walk Out technology's third-party deployment, and how UPS's restructuring ripples through other logistics companies' strategies.

Related Articles

EC & AI Commerce News Digest (January 27, 2026)

Visa and Inception announce agentic commerce partnership in CEMEA region. eMarketer's AI Commerce 2026 report predicts $144 billion market by 2029. Data ownership and brand loyalty risks for retailers adopting AI commerce.

Mastercard Launches "Agent Suite" for Agentic Commerce — AI Agent Building Service for Banks and Merchants

Mastercard announces Agent Suite for AI agent building and deployment. Analysis of the difference from Agent Pay and integrations with Google, Microsoft, and OpenAI

Phia: The AI Shopping Agent Founded by Bill Gates' Daughter Raises $35 Million

AI shopping agent Phia raises $35M in Series A. Deep dive into the service offering price comparison, resale suggestions, and personalized recommendations