Amazon Considers Building "Content Marketplace" to Sell Media Content to AI Companies — Race for AI Training Data Infrastructure Heats Up Following Microsoft

Akihiro Suzuki

Twitter

Source: techcrunch.com

Key Takeaways

- Amazon reportedly plans to build a marketplace where publishers can sell content to AI companies

- Microsoft just launched Publisher Content Marketplace (PCM) last week, intensifying competition for AI training data licensing infrastructure

- Publisher traffic collapse due to AI summaries is driving content licensing as a new revenue stream for media

Amazon Plans to Build AI Content Marketplace

Amazon may launch a marketplace where media sites can sell their content to AI companies

Amazon is reportedly working on a marketplace that would allow media companies to sell their content to AI companies for training data.

On February 10, 2026, according to The Information, Amazon is considering building a marketplace that would allow media publishers to sell their content directly to AI companies. Amazon reportedly distributed slide materials mentioning a content marketplace to stakeholders ahead of an AWS-hosted publisher conference.

In response to TechCrunch's inquiry, Amazon's spokesperson did not deny the report, commenting: "Amazon has built innovative relationships with publishers over many years, and we're always working together to innovate to provide the best service to customers, but we have nothing specific to share at this time."

Background and Industry Trends

Content licensing for AI training data is one of the most important themes in the tech industry in 2026. Three major structural changes underpin this development.

First, copyright lawsuits are surging. Lawsuits over unauthorized AI training have exceeded 50 cases, with Universal Music and others filing a $3.1 billion lawsuit against Anthropic in January 2026, among others. Legal risks continue to expand. The U.S. Copyright Office also published comprehensive guidance on fair use determinations for AI training in May 2025, indicating that fair use is unlikely to be recognized, particularly in journalism.

Second, publishers face a traffic crisis. Traffic decline due to AI search is severe. According to AdExchanger, organic search traffic from Google to news publishers has dropped 33% globally and 38% in the U.S. Business Insider saw organic search traffic fall 55% and laid off 21% of its staff.

Third, the AI training data market itself is growing rapidly. According to MarketsandMarkets research, the AI training dataset market is projected to grow from $2.68 billion in 2024 to $11.16 billion by 2030, an annual average growth rate of over 22%.

Microsoft's PCM Launch and Amazon's Counter-Strategy

Microsoft made the first move in this space. On February 4, 2026, Microsoft officially announced Publisher Content Marketplace (PCM). PCM features include:

- Publishers can set their own pricing and licensing terms

- Transparency features that report content usage

- Major publishers including Business Insider, Conde Nast, Hearst Magazines, AP, USA TODAY, and Vox Media have joined

- Microsoft collects transaction fees (specific rates undisclosed)

Amazon's concept is expected to take a different approach from Microsoft. According to PYMNTS analysis, Amazon is looking to build an environment where AI developers can procure training data and rent computing resources in one place by integrating AWS cloud infrastructure with the content marketplace.

Amazon already has a track record in content licensing. In 2025, it signed an AI content licensing agreement with The New York Times worth $20-25 million annually, and Alexa+ integrates content from over 200 media outlets. The marketplace concept aims to standardize and platformize these individual agreements.

Publishers reportedly support usage-based payment, and IndexBox reports that a systematic licensing center for books, articles, and images is envisioned.

Integration with AWS AI Infrastructure Strategy

The content marketplace concept must be understood in the context of AWS's overall AI infrastructure business. According to WinBuzzer, integration with Bedrock (AWS's foundation model platform) would allow AI developers to handle everything from training data procurement to model training on a single platform.

According to Citizens Analyst Andrew Boone's analysis, Anthropic alone is expected to spend approximately $7 billion on inference and $12 billion on training on AWS in 2026, with Amazon capturing the majority. The content marketplace positions itself to form a more comprehensive AI development platform by combining legitimate training data supply with this infrastructure investment.

Meanwhile, OpenAI has already signed individual content licensing agreements with AP, Vox Media, News Corp, The Atlantic, and others, with amounts reportedly ranging from $1-5 million annually. Transitioning to a marketplace model could enable publishers to negotiate more favorable terms.

Impact and Implications for E-Commerce Businesses

Amazon's content marketplace concept is not irrelevant to e-commerce businesses.

There will be spillover effects on AI shopping assistant information quality. As AI models are trained on licensed high-quality content, product recommendations and review summaries may become more accurate. If Amazon's own AI assistants like Alexa and Rufus can provide high-quality product information leveraging media content, positive impacts on e-commerce conversion rates can be expected.

This is the time for e-commerce businesses to reassess the asset value of their content. For e-commerce businesses that possess product reviews, buyer's guides, and specialized content, new revenue opportunities may emerge by licensing that content as AI training data. Niche category expertise and UGC (user-generated content) in particular may hold high value for AI model quality differentiation.

Preparing for copyright risks is also important. New AI copyright legislation is being proposed in the U.S., and the legality of content use is increasingly being questioned. E-commerce businesses should monitor whether their site content is being scraped by AI and consider implementing robots.txt settings or open standards like RSL (Really Simple Licensing) as needed.

Summary

Amazon's content marketplace concept is part of the evolution from "individual negotiations" to "platform-type marketplaces" for AI training data procurement. The picture of Microsoft launching PCM first and Amazon following signals the beginning of a platform war over content distribution infrastructure in the AI era.

For publishers, this represents a potential new revenue stream to offset traffic declines caused by AI, while also requiring strategic decisions about which platform to commit to. For e-commerce businesses, this is an opportunity to take inventory of their own content assets and consider strategies for integration into the AI ecosystem.

Related Articles

The AI Commerce Three-Way Battle: Google, Amazon, and OpenAI Clash Over the Next-Gen E-Commerce Market

Google, Amazon, and OpenAI are competing with different approaches in the AI commerce market. McKinsey predicts a $3-5 trillion market opportunity by 2030. E-commerce businesses need to prepare for multi-protocol support.

Amazon CEO Announces AI Shopping Strategy at Davos, $10 Billion OpenAI Investment Negotiations Underway

Amazon CEO Andy Jassy unveiled his vision for AI-driven shopping transformation at Davos. Negotiations for over $10 billion investment in OpenAI are ongoing, with the AI shopping agent market expected to grow to $1 trillion.

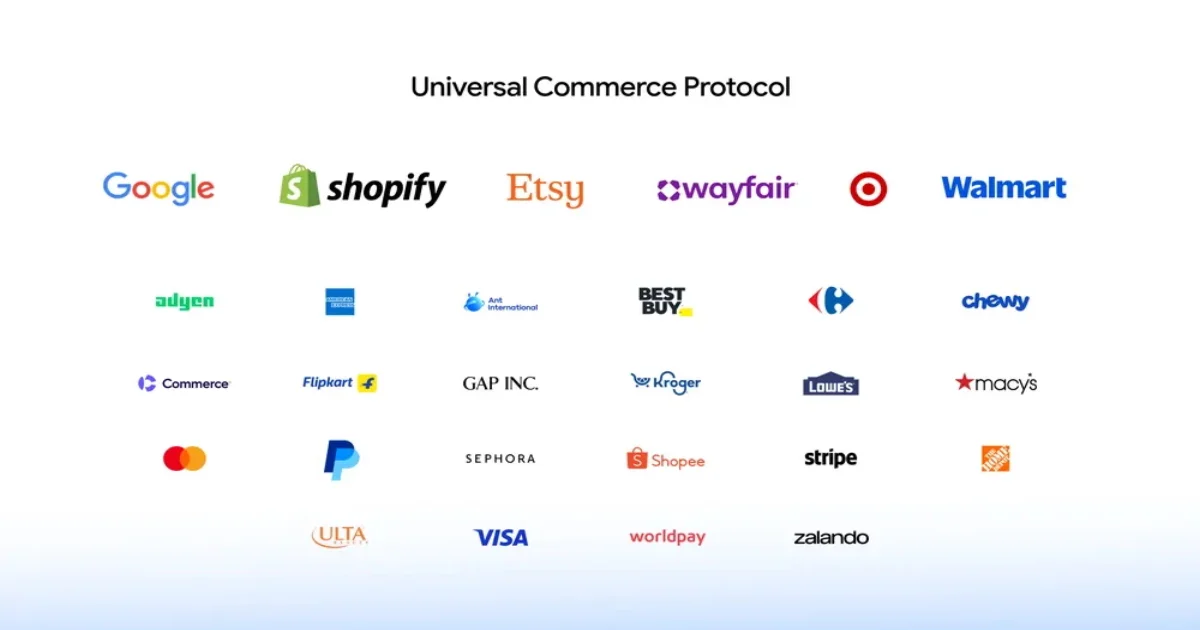

Google's UCP Announcement Reshapes Agentic Commerce Landscape, Questions Amazon's Retail Dominance

Google announces Universal Commerce Protocol with over 20 partners including Walmart and Shopify, while Amazon notably absent. The agentic commerce era's power dynamics may be shifting significantly.