Amazon Rufus: The Full Picture of the AI Shopping Assistant Used by 250 Million People

Akihiro Suzuki

Twitter

Source: www.aboutamazon.com

Key Takeaways

- Amazon's AI assistant Rufus reaches 250 million users, contributing $10 billion in annual sales growth

- Personalization and AutoBuy features position it as a pioneer in agentic commerce

- E-commerce businesses urgently need to optimize product data and prepare for AI

Rufus Reaches 250 Million Users, $10 Billion Sales Impact

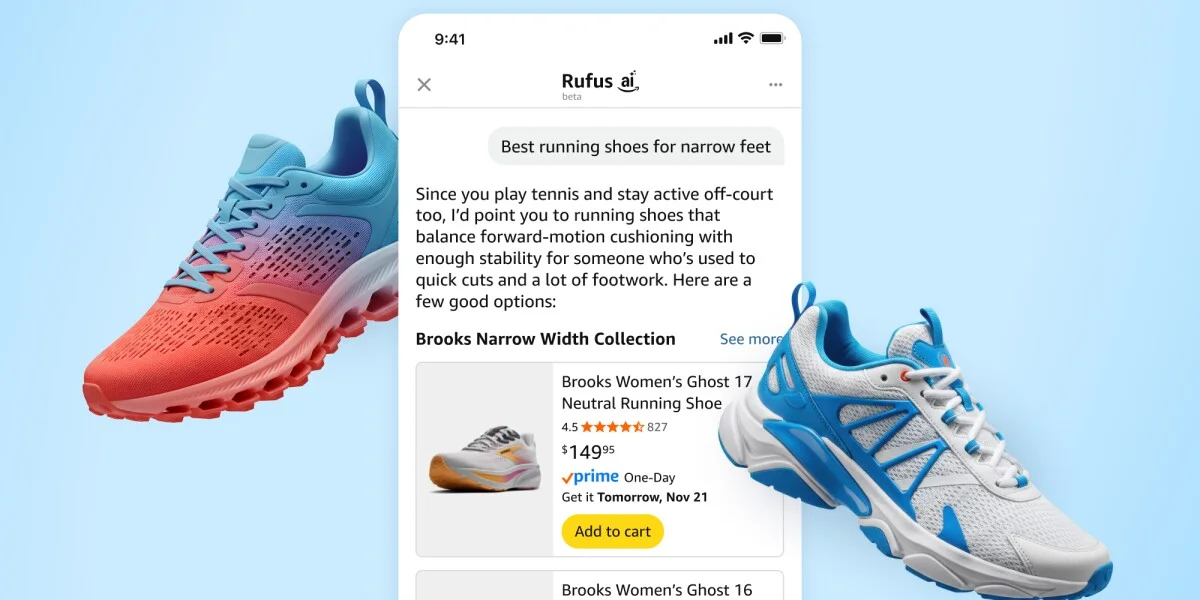

Amazon's AI shopping assistant gets smarter and more personal

Amazon's generative and agentic AI assistant for shopping continues to evolve with new personalized features.

Amazon's AI shopping assistant "Rufus" has achieved remarkable growth. Over 250 million customers used Rufus in 2025, with monthly active users up 149% year-over-year and interactions up 210%.

CEO Andy Jassy revealed in the Q3 2025 earnings call that Rufus is projected to generate $10 billion in additional annual sales. This is backed by the fact that customers who use Rufus have over 60% higher purchase completion rates.

Amazon implemented over 50 technical upgrades throughout the year, significantly improving shopping knowledge, product research capabilities, and recommendation accuracy.

Background and Industry Trends

Competition in AI shopping assistants has intensified entering 2026. Research shows that 58% of consumers believe AI tools are replacing search engines for product recommendation tasks.

Currently, major players are engaged in a three-way battle.

Amazon has adopted a "walled garden strategy" centered on Rufus, blocking access from external AI agents. This is also a decision to protect its $56 billion annual advertising business.

Walmart has partnered with OpenAI to deploy the AI assistant "Sparky," actively accepting traffic from ChatGPT. ChatGPT now accounts for approximately 20% of Walmart's referral traffic.

Google/OpenAI alliance is deepening partnerships with Target, Instacart, DoorDash and others. ChatGPT has reached 800 million weekly active users, with approximately 50 million shopping-related queries per day.

Notably, Amazon is blocking external AI crawlers. This prevents ChatGPT and Perplexity from accessing Amazon's product information, directing consumers to competing retailers when comparison shopping.

The Technology Architecture Behind Rufus

Rufus's technical foundation consists of Amazon's custom LLM combined with multiple advanced models.

Multi-Model Architecture

Rufus leverages Amazon Bedrock, operating with a combination of the following models:

- Anthropic Claude Sonnet: For advanced reasoning tasks

- Amazon Nova: For multi-step reasoning

- Custom LLM: Trained on Amazon's product catalog, customer reviews, and community Q&A

RAG (Retrieval-Augmented Generation) System

In addition to training data, Rufus references the following data sources in real-time:

- Amazon product catalog

- Customer reviews

- Community Q&A

- Stores API

- Public web information

This RAG architecture enables accurate responses based on the latest product information.

Infrastructure Optimization

Rufus utilizes over 80,000 AWS Trainium and Inferentia chips. These dedicated chips reduce costs by 4.5x compared to other solutions while maintaining low latency.

The introduction of parallel decoding technology has doubled response times and reduced inference costs by 50%. With streaming architecture, users can see responses within one second.

Personalization and AutoBuy: Evolution to Agentic Commerce

Rufus's key features are its deep personalization capabilities and agentic auto-purchase functionality.

Account Memory Feature

Rufus remembers individual users' purchase history, browsing patterns, and past conversations. For example, it remembers information like "has sports-loving sons aged 5 and 8," "owns a shedding Golden Retriever," or "prefers organic food," and makes recommendations accordingly.

Activity from Kindle, Prime Video, and Audible will be integrated in the future, enabling recommendations based on behavior across the entire Amazon ecosystem.

AutoBuy (Auto-Purchase) Feature

The AutoBuy feature, quietly released in November 2025, represents the cutting edge of agentic commerce.

How it works:

- User sets a target price for a product

- Rufus monitors the price

- When the target price is reached, it automatically completes the purchase

- Cancellation is possible within 24 hours

According to actual user reports, after setting an auto-buy alert for a $25 product at below $20, the auto-purchase was completed by the next morning. Prime members using AutoBuy are achieving an average of 20% savings.

Other Advanced Features

- Price Tracking: View 30-day and 90-day price history

- Help Me Decide: Guidance when overwhelmed by too many choices

- Visual Search: Photograph handwritten shopping lists to add to cart

Challenges and Criticism: Accuracy Issues and Bias

Rufus has faced criticism for several issues.

Accuracy Problems

According to independent research, Rufus's recommendation accuracy is reported to be only 32%. Washington Post testing confirmed cases where cycling glove recommendations were inadequate, or no products were recommended at all for specific questions.

User communities like Reddit have voiced harsh criticism such as "Rufus is the worst AI I've ever used" and "completely unreliable."

First-Party Product Bias

More concerning is the bias toward Amazon's own products. Research has confirmed the following tendencies:

- 83% of Rufus's recommendations are Amazon-sold products

- Amazon Basics appears in 41% of recommendations (6x more than market share would justify)

- Tendency to bury alternatives that are better on other sites

An Amazon spokesperson stated, "Generative AI is still in its early stages, and we take accuracy very seriously," promising continued improvements.

Impact and Strategies for E-commerce Businesses

The rise of Rufus has significant implications for e-commerce businesses.

Product Data Optimization Is Essential

Rufus references product catalogs, reviews, and Q&A through its RAG system. E-commerce businesses need the following measures:

- Enhanced product descriptions: Clearly state specific uses, target users, and usage scenarios

- Leverage Q&A sections: Build comprehensive FAQs with quality answers

- Review management: Strengthen initiatives to obtain high-quality reviews

AI Crawler Response Decisions

While Amazon blocks external AI, Walmart welcomes it. Businesses with their own e-commerce sites need to decide their AI crawler response policy:

- Open strategy: Aim for increased traffic from ChatGPT and others

- Protective strategy: Guard proprietary data and user experience

Preparing for Agentic Payments

As auto-purchase features like AutoBuy become widespread, the traditional purchase funnel will change. The following preparations are needed:

- Automation of competitive pricing

- Real-time inventory updates

- Clear return/cancellation policies

Conclusion

Amazon Rufus leads the AI shopping assistant market with its 250 million user base and $10 billion sales contribution. Features like personalization, AutoBuy, and price tracking embody the future of agentic commerce.

However, the 32% accuracy rate and first-party product bias are issues that cannot be ignored. Evercore ISI predicts that Rufus will boost Amazon's retail gross merchandise volume by 4.44% and increase advertising revenue by $4 billion by 2028.

For e-commerce businesses, optimization to become products "chosen by" algorithms like Rufus is no longer optional but essential. Starting now with enhanced product data, AI-era SEO, and preparation for agentic payments is critical.

Related Articles

What is Agentic Commerce? Explaining the New Era of AI-Powered Purchasing

Explore the full scope of Agentic Commerce. AI agents autonomously execute everything from product selection to payment on behalf of users. Discover shocking data including 4,700% increase in AI-driven traffic and 20% of Walmart's traffic from ChatGPT, along with three essential preparation steps companies should start immediately.

Amazon vs Walmart: Contrasting Strategies in Agentic Commerce

Walmart adopts Google UCP and promotes open standards. Amazon maintains proprietary systems with a closed approach. How these choices will shape the market's future.

The AI Commerce Three-Way Battle: Google, Amazon, and OpenAI Clash Over the Next-Gen E-Commerce Market

Google, Amazon, and OpenAI are competing with different approaches in the AI commerce market. McKinsey predicts a $3-5 trillion market opportunity by 2030. E-commerce businesses need to prepare for multi-protocol support.