Microsoft Copilot Checkout Arrives: AI Commerce Market Now Has Four Major Players

Akihiro Suzuki

Twitter

Source: fourweekmba.com

Key Takeaways

- Microsoft's Copilot Checkout launch establishes a four-player AI commerce market

- Google, OpenAI, Microsoft, and Perplexity compete with different protocols and revenue models

- E-commerce businesses must understand each platform's revenue model to make informed decisions

Four Power Blocs Emerge in the AI Commerce Market

Microsoft Copilot Checkout Enters the AI Commerce Race

Microsoft launches Copilot Checkout, entering the agentic commerce race with its own in-chat purchasing capability.

On January 8, 2026, Microsoft officially announced "Copilot Checkout" at NRF 2026. This marks the beginning of a full-scale competitive era in AI commerce, with Google, OpenAI, Microsoft, and Perplexity emerging as the "four major players."

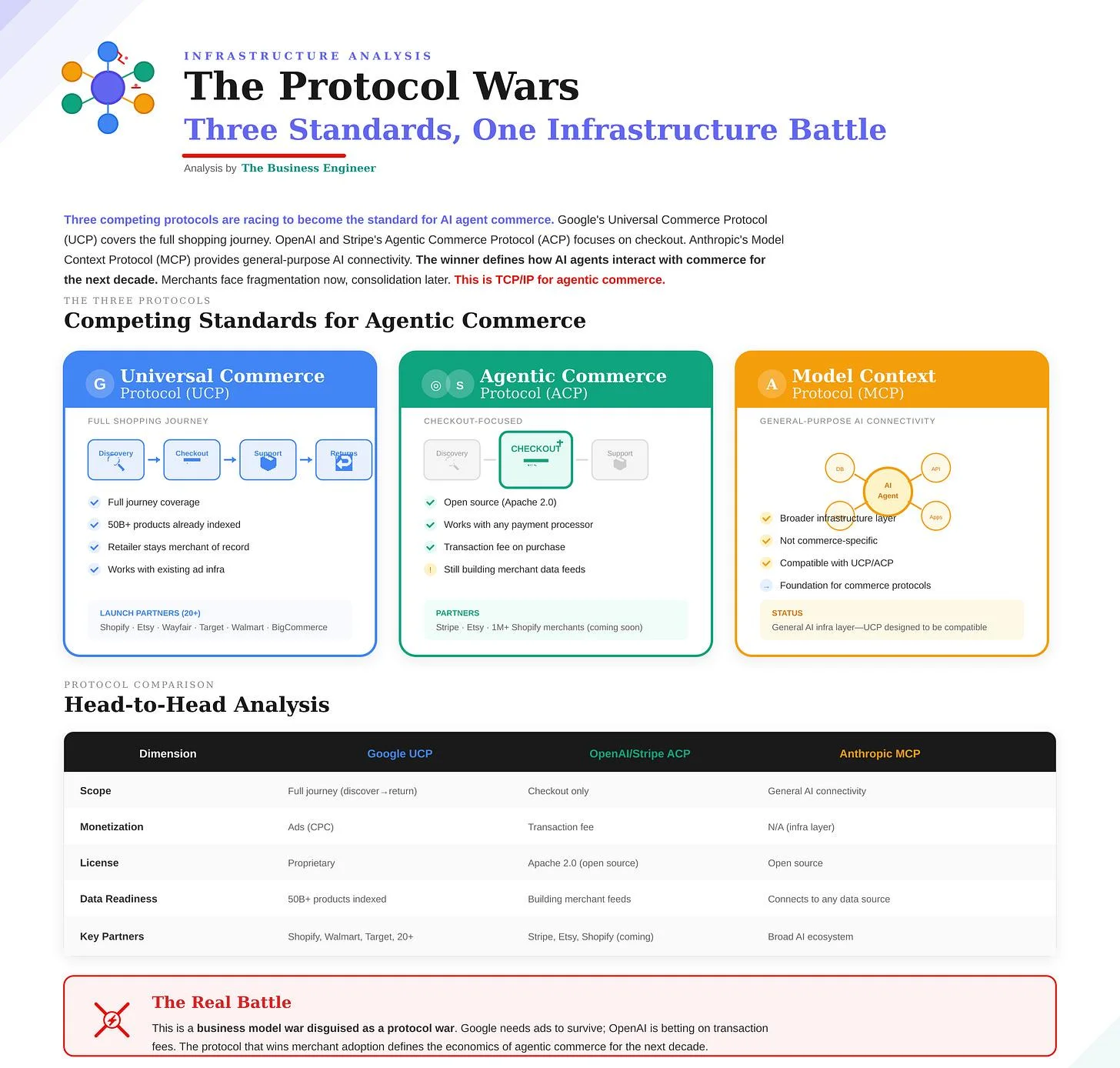

Each player has its own protocol and revenue model, competing for dominance in AI-mediated shopping experiences. FourWeekMBA's analysis organizes this competitive landscape as follows:

| Platform | Protocol | Revenue Model |

|---|---|---|

| Universal Commerce Protocol (UCP) | CPC Advertising | |

| OpenAI | Agentic Commerce Protocol (ACP) | Transaction Fee |

| Microsoft | Copilot Checkout | TBD |

| Perplexity | PayPal Integration | TBD |

Background and Industry Trends

The AI commerce market is projected to reach $20.9 billion in 2026. Furthermore, McKinsey's report predicts a $3-5 trillion market opportunity globally by 2030.

Traditional e-commerce followed a "search → visit site → compare → purchase" flow. In agentic commerce, these discrete steps transform into a seamless experience: "instruct AI → complete purchase in chat."

It's noteworthy that each company has adopted different revenue models. Google is following its traditional advertising business model, while OpenAI is pioneering a transaction fee approach.

Strategies and Developments of the Four Major Players

Google: Building an Ecosystem with Open Standards (CPC Advertising Model)

Google announced the Universal Commerce Protocol (UCP) at NRF on January 11, 2026. UCP is an open standard covering the entire shopping journey from product discovery to purchase and post-purchase support.

It was co-developed with Shopify, Etsy, Wayfair, Target, and Walmart, with more than 20 companies including Adyen, American Express, Best Buy, Mastercard, Stripe, Visa, and Zalando expressing support.

Revenue Model: CPC AdvertisingGoogle's strategy is clear. Similar to search advertising, they charge CPC (cost-per-click) for product exposure through AI agents. They're applying the model refined through their advertising business to AI commerce.

OpenAI: Deep Integration with Payment Infrastructure (Transaction Fee Model)

In September 2025, OpenAI announced the Agentic Commerce Protocol (ACP) through a partnership with Stripe. This enables "Instant Checkout" functionality for direct purchases within ChatGPT.

ACP is open-sourced under the Apache 2.0 license, with over 1 million Shopify merchants scheduled to support it. Businesses already using Stripe can enable agentic payments with just one line of code.

Revenue Model: Transaction FeeOpenAI has adopted a revenue model based on transaction fees rather than advertising. This fundamentally differs from traditional advertising models by charging for "completed purchases." For e-commerce businesses, this provides clearer ROI visibility.

Microsoft: Leveraging Enterprise Infrastructure (Revenue Model TBD)

Microsoft partnered with PayPal, Stripe, and Shopify to enable purchase completion within Copilot.

Their strengths include over 100 million monthly Copilot users and more than 800 million users accessing AI features through Microsoft 365 and Azure. Enterprise customers particularly want "solutions that stay within the Microsoft ecosystem."

Revenue Model: TBDInterestingly, despite being OpenAI's largest shareholder with over $13 billion invested, Microsoft is building separate infrastructure from OpenAI's ACP. FourWeekMBA points out Microsoft's judgment that "commerce is too strategic to outsource." While the revenue model is unannounced, possibilities include supplementing subscription revenue or an advertising model.

Perplexity: Search AI-Focused Approach (Revenue Model TBD)

In November 2025, Perplexity launched its "Instant Buy" feature through a partnership with PayPal. Users can complete the journey from product research to purchase within a single chat.

Over 5,000 PayPal merchants are already supported, including Abercrombie & Fitch, Ashley Furniture, Wayfair, and NewEgg. Merchants on BigCommerce, Shopware, and Wix platforms are also compatible.

Revenue Model: TBDWhile Perplexity previously served as an intermediary in purchases through "Buy With Pro," the new model allows merchants to maintain customer relationships as "merchants of record." Through their strategic partnership with PayPal, they're focused on user acquisition, including offering free Perplexity Pro (worth $200/year) to PayPal/Venmo users.

How Different Revenue Models Impact E-commerce Businesses

The revenue model differences among the four players are crucial decision factors for e-commerce businesses.

CPC Advertising Model (Google)- Advantage: Predictable exposure costs

- Disadvantage: Cost burden when clicks don't convert to purchases

- Advantage: Performance-based with clear ROI

- Disadvantage: Fee rates may compress profit margins

- Need to monitor future announcements

- Potential for favorable early-adopter terms

Impact and Action Items for E-commerce Businesses

Short-term Actions (2026)

1. Review your payment infrastructureShopify merchants can automatically support multiple platforms. Stripe users can easily adopt ACP, while PayPal users can easily support Perplexity.

2. Compare platform revenue modelsGoogle's CPC advertising leverages existing ad operation expertise. OpenAI's transaction fees are worth considering as a new customer acquisition channel. For Microsoft and Perplexity, advance technical preparation while waiting for revenue model announcements is recommended.

3. Prioritize structured data implementationStructured product data is essential for AI to properly understand and recommend products on any platform. Prioritize schema markup implementation.

Long-term Perspective

In the agentic commerce era, "which AI selects your products" will determine sales. Compare each platform's revenue model against your profit structure to determine the optimal channel mix.

A "multi-platform strategy" supporting multiple of the four players is a realistic option. Dependency on a single platform carries risk.

Conclusion

Microsoft's Copilot Checkout entry has clearly established a "four major players" structure in the AI commerce market: Google, OpenAI, Microsoft, and Perplexity.

Notable is how each player has adopted different revenue models. Google uses CPC advertising while OpenAI charges transaction fees—a clear distinction—while Microsoft and Perplexity are still exploring their models.

For e-commerce businesses, the question isn't just "which platform to support" but "which revenue model suits our business." Start by reviewing your payment infrastructure and calculating implementation costs and expected returns.

Related Articles

What is Agentic Commerce? Explaining the New Era of AI-Powered Purchasing

Explore the full scope of Agentic Commerce. AI agents autonomously execute everything from product selection to payment on behalf of users. Discover shocking data including 4,700% increase in AI-driven traffic and 20% of Walmart's traffic from ChatGPT, along with three essential preparation steps companies should start immediately.

What is Instant Checkout? Revolutionary Feature for In-Chat Purchase Completion

[2-Minute Read] Learn about Instant Checkout mechanisms and benefits. Discover how completing product discovery to purchase within AI chat reduces abandonment and boosts conversion in Agentic Commerce implementation.

Google Announces Universal Commerce Protocol (UCP), Forms Major Coalition for Agentic Commerce Standardization

Google unveiled UCP at NRF 2026, an open standard co-developed with Shopify, Walmart, and 20+ partners to standardize AI agent-powered shopping experiences.