2026 Logistics Revolution: Smart Terminals and Cargo Drones Transforming Air Freight

Akihiro Suzuki

Twitter

Source: www.stattimes.com

Key Takeaways

- AI and AMR reduce smart terminal processing errors by 70%

- $8.1T e-commerce market driving demand, freighters to increase 45% to 3,420 by 2046

- 200-500kg cargo drones revolutionizing middle-mile transport

The Arrival of the "Human-Light" Logistics Revolution

Rise of smart terminal: Inside the human-light revolution of 2026

Driven by a massive e-commerce surge and the urgent push for Net Zero, the air cargo sector of 2026 is a digital-first frontier.

In 2026, the air cargo industry is in the midst of a "human-light" revolution. AI image recognition systems, autonomous mobile robots (AMR), and cargo drones are being deployed in succession, rapidly automating traditionally labor-intensive operations.

Background and Industry Trends

The $8.1 Trillion E-Commerce Market Driving Change

Accelerating automation in air cargo is the $8.1 trillion e-commerce market. The delivery speed competition in online shopping has made increased processing capacity at logistics facilities essential.

Freighter Demand Forecast

According to IATA data, dedicated freighters are expected to reach 3,420 aircraft by 2046, a 45% increase from current levels. Additional aircraft needed between 2026 and 2030:

| Category | Aircraft |

|---|---|

| Narrowbody | 1,120 |

| Medium Widebody | 855 |

| Large Widebody | 630 |

| Total | 2,605 |

Of these, 1,670 will be conversions from passenger aircraft (P2F: Passenger to Freighter), with 935 newly manufactured.

Smart Terminal Implementation Examples

CargoLand by LGG (Liège Airport)

CargoLand, operated at Belgium's Liège Airport, is a pioneering example of "human-light" terminal design.

Technologies Deployed:- AI image recognition systems: Automated package identification and sorting

- Autonomous mobile robots (AMR): Automated pallet transport

- Digital twin: Real-time workflow simulation

- 70% reduction in processing errors

- Improved palletizing and sorting accuracy

- Workers focus on monitoring and exception handling

The Rise of Cargo Drones

For medium-distance transport (within several hundred kilometers), cargo drones in the 200-500kg class are entering practical deployment.

Key Players:- Dronamics (Bulgaria/UK): Fixed-wing cargo drones

- Elroy Air: Hybrid VTOL type

- Sabrewing Aircraft Company: Large cargo drones

These enable more efficient medium-distance transport than traditional trucking or small aircraft, with particular promise for "middle-mile" transport before last-mile delivery.

Progress in Alternative Propulsion Technologies

eVTOL (Electric Vertical Take-Off and Landing)

Electric vertical take-off and landing aircraft (eVTOL) are transitioning from prototype to certification stages. Once aviation authorities grant type certificates, they could revolutionize cargo transport in urban areas.

Hydrogen Propulsion

For regional cargo transport, hydrogen propulsion system development is also progressing. With SAF (Sustainable Aviation Fuel) still below 1% of fuel consumption as of 2026, hydrogen is attracting attention as a medium to long-term decarbonization solution.

Impact and Applications for E-Commerce Businesses

Expectations for Delivery Speed

With the spread of smart terminals, the following improvements can be expected:

- Reduced processing time: Improved throughput through automation

- Reduced errors: Fewer mis-deliveries through AI identification

- 24-hour operation: Nighttime processing by robots

Changes in Cost Structure

While initial investment increases, operating costs are expected to decline over the long term. Automation-driven competitiveness improvements will be particularly notable in regions with high labor costs.

Perspectives for Partner Selection

When selecting logistics partners, we recommend confirming the following:

- Automation investment status: Investment plans for smart terminals

- Error rate track record: KPIs for processing accuracy

- Technology roadmap: Plans for drone and eVTOL deployment

Implications for Small and Medium E-Commerce Businesses

While large logistics companies will lead major automation investments, small and medium e-commerce businesses will benefit from these developments. By choosing logistics partners that are aggressive about automation, they can indirectly enhance their competitiveness.

Summary

The air cargo industry in 2026 is in the midst of a "human-light" revolution driven by AI, robots, and drones. As CargoLand demonstrates, a 70% reduction in processing errors has already been achieved.

The expansion of the e-commerce market to $8.1 trillion and the forecast of 45% more freighters by 2046 suggest this automation trend will accelerate. The practical deployment of 200-500kg cargo drones will also contribute to more efficient medium-distance transport.

E-commerce businesses should check their logistics partners' automation investment status and assess future service quality and cost competitiveness. The transformation in air cargo has the potential to significantly improve the e-commerce delivery experience.

Related Articles

What is Agentic Commerce? Explaining the New Era of AI-Powered Purchasing

Explore the full scope of Agentic Commerce. AI agents autonomously execute everything from product selection to payment on behalf of users. Discover shocking data including 4,700% increase in AI-driven traffic and 20% of Walmart's traffic from ChatGPT, along with three essential preparation steps companies should start immediately.

EC & AI Commerce News Digest (January 19, 2026)

eBay announces 3 ways AI will impact ecommerce, JD launches buyout of Deppon Logistics at 35% premium for $544M, China's Spring Festival e-commerce accelerates cross-border trade reaching 2.75 trillion yuan in 2025.

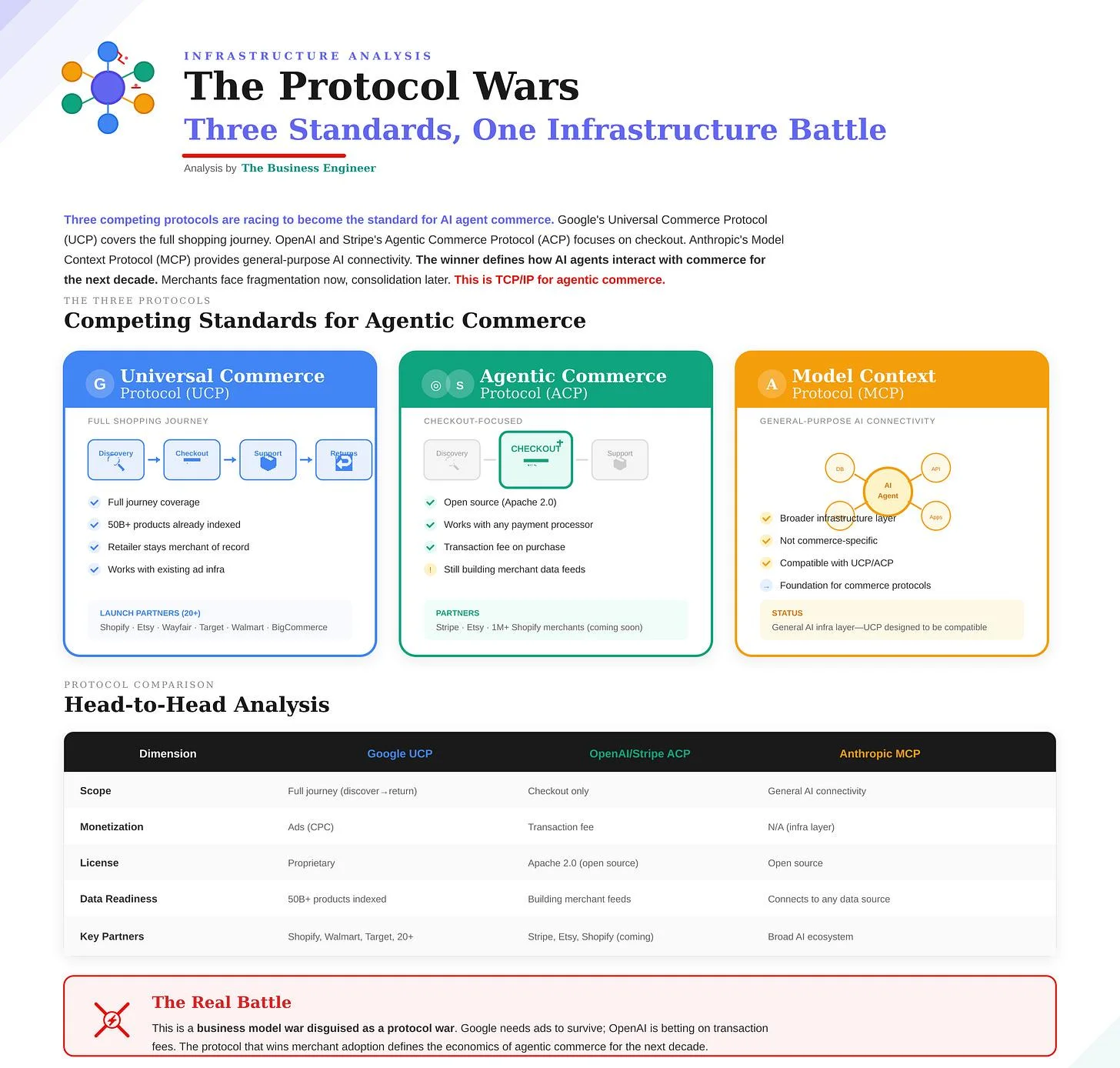

Microsoft Copilot Checkout Arrives: AI Commerce Market Now Has Four Major Players

Google, OpenAI, Microsoft, and Perplexity compete for AI commerce dominance with different protocols and revenue models. Here's what e-commerce businesses need to know about each player's strategy.