JD's Full Acquisition of Deppon Logistics: $544M at 35% Premium Marks China Logistics Consolidation

Akihiro Suzuki

Twitter

Source: www.mingtiandi.com

Key Takeaways

- JD Logistics launches tender offer for remaining Deppon Logistics shares at 35% premium

- Total acquisition value: 3.797 billion yuan (~$544M)

- From 66% stake in 2022 to full ownership, accelerating logistics network integration

JD Logistics Announces Full Acquisition

JD Launches Buyout of Shanghai-Listed Deppon Logistics at 35% Premium

JD Logistics is offering to buy out the remaining shares in Shanghai-listed Deppon Logistics at a 35 percent premium.

On January 18, JD Logistics announced a tender offer to acquire all remaining shares of Shanghai Stock Exchange-listed Deppon Logistics. The offer price is 19 yuan per share (approximately $2.72), representing a 35% premium over the January 9 closing price of 14.04 yuan.

Background and Industry Trends

The JD-Deppon Relationship

The relationship between JD Logistics and Deppon Logistics began in 2022. At that time, JD acquired 66% of Deppon for 8.976 billion yuan, gaining:

- 143 sorting hubs

- Over 30,000 service points

- 15,000 trucks

Since then, JD has gradually increased its stake to the current 80.01%. This tender offer aims to acquire the remaining approximately 20% for full ownership.

China's Logistics Industry Consolidation

In China's e-commerce logistics market, vertical integration by platform companies is accelerating. JD has traditionally built its strength on its proprietary logistics network, but the Deppon acquisition significantly enhanced its LTL (Less Than Truckload) transportation capabilities.

This full acquisition also addresses regulatory requirements in China to resolve conflicts of interest with listed subsidiaries.

Transaction Details

Financial Terms

| Item | Details |

|---|---|

| Offer Price | 19 yuan per share (~$2.72) |

| Premium | 35% (vs. Jan 9 close of 14.04 yuan) |

| Target Shares | 199,855,259 shares |

| Total Value | ~3.797 billion yuan ($544M) |

| Funding | Internal funds or borrowing |

Approval Requirements

This transaction requires approval from more than two-thirds of voting rights held by non-major shareholders and non-executive directors. Regulatory approval is also required.

Strategic Significance

JD Logistics Statement

JD Logistics stated in its official announcement:

Acquiring Deppon's remaining stake will enable further integration of logistics networks and creation of synergies between the two companies, strengthening our position as an industry leader in freight delivery.

引用元:JD Logistics

Expected Synergies

- Network Integration: Optimizing JD's parcel delivery network with Deppon's LTL network

- Cost Reduction: Consolidating overlapping sorting facilities and service points

- Service Expansion: Providing consistent service to both B2B and B2C

- Technology Sharing: Deploying JD's logistics technology to Deppon

Impact and Applications for E-Commerce Businesses

Logistics Choices in the Chinese Market

The JD×Deppon integration may change logistics service options in China:

- Within JD Ecosystem: More integrated services, potential cost reductions

- Competing Platforms: May need to consider alternative logistics partners

Implications for Global Expansion

Vertical integration by major Chinese logistics players also impacts global expansion. JD is already expanding logistics services to Southeast Asia and Western markets, and full Deppon integration could accelerate this movement.

Impact on Japanese Companies

For Japanese companies engaged in cross-border e-commerce to and from China, the strengthened logistics capabilities of the JD Group mean:

- Enhanced LTL transportation options

- Improved efficiency in domestic China delivery

- Potentially improved cost competitiveness

Summary

JD's full acquisition of Deppon symbolizes the maturation and consolidation of China's e-commerce logistics market. The 35% premium indicates that JD sees high strategic value in Deppon's assets.

Moving from a 66% stake in 2022 to full ownership in about four years demonstrates the pace of logistics vertical integration in the Chinese market. E-commerce businesses should continue to monitor how this consolidation affects their logistics strategies.

Going forward, key areas to watch include post-integration service content and pricing changes, as well as responses from other Chinese logistics companies (SF Express, ZTO, etc.).

Related Articles

What is Agentic Commerce? Explaining the New Era of AI-Powered Purchasing

Explore the full scope of Agentic Commerce. AI agents autonomously execute everything from product selection to payment on behalf of users. Discover shocking data including 4,700% increase in AI-driven traffic and 20% of Walmart's traffic from ChatGPT, along with three essential preparation steps companies should start immediately.

EC & AI Commerce News Digest (January 19, 2026)

eBay announces 3 ways AI will impact ecommerce, JD launches buyout of Deppon Logistics at 35% premium for $544M, China's Spring Festival e-commerce accelerates cross-border trade reaching 2.75 trillion yuan in 2025.

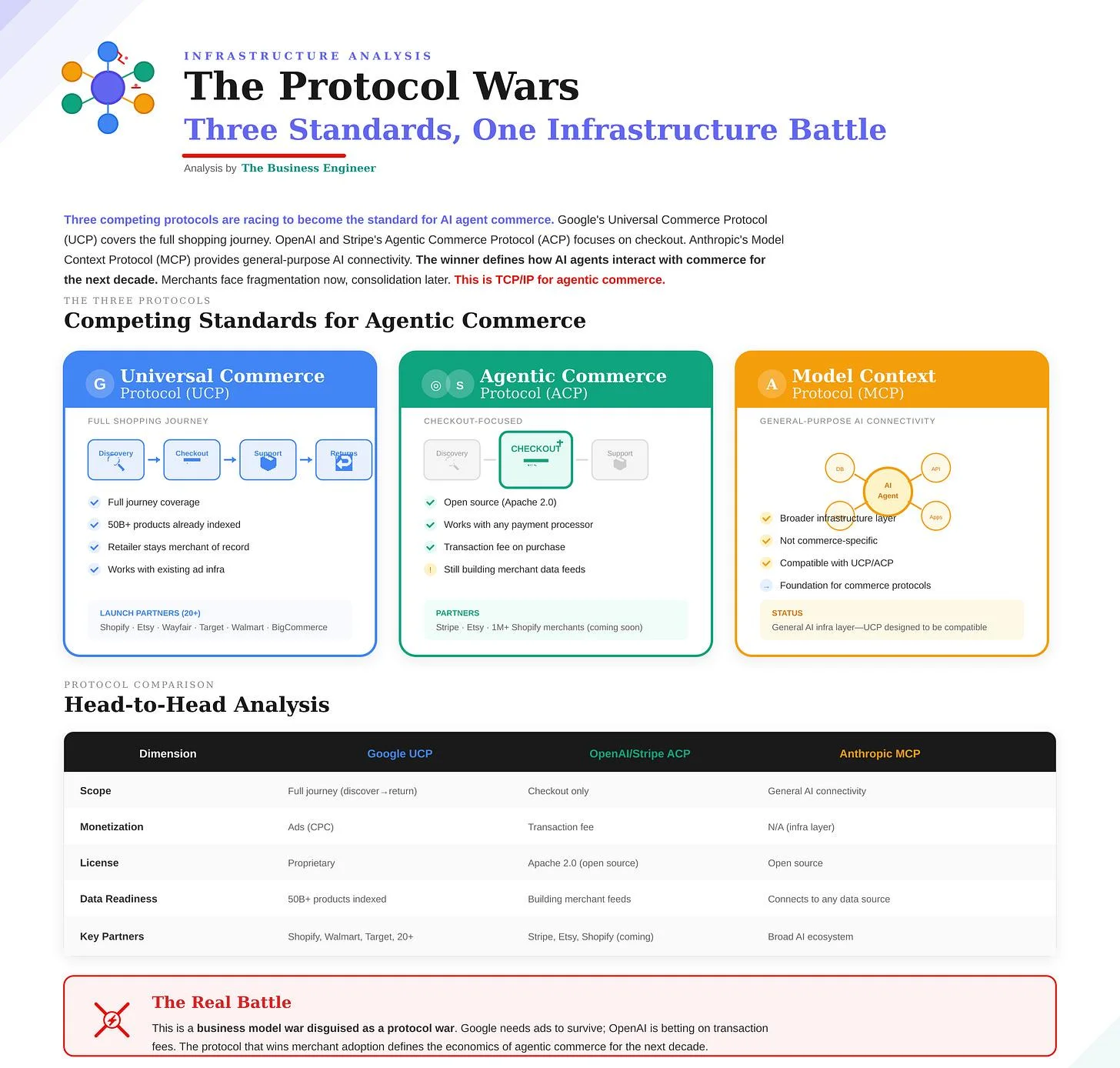

Microsoft Copilot Checkout Arrives: AI Commerce Market Now Has Four Major Players

Google, OpenAI, Microsoft, and Perplexity compete for AI commerce dominance with different protocols and revenue models. Here's what e-commerce businesses need to know about each player's strategy.