Amazon to Close All Amazon Go and Amazon Fresh Stores—Strategic Shift to Whole Foods Expansion and Same-Day Delivery

Akihiro Suzuki

Twitter

Source: techcrunch.com

Key Takeaways

- Amazon closes all Amazon Go (15 stores) and Amazon Fresh (57 stores) by February 1

- Unable to build "unique customer experience and economic model," pivoting to Whole Foods expansion and same-day delivery

- E-commerce businesses should note this turning point where delivery infrastructure investment outweighs physical retail as a commerce success factor

Amazon's Major Physical Retail Strategy Overhaul

Amazon is closing its physical Amazon Go and Amazon Fresh stores

Upon closing down some stores in 2024, an Amazon spokesperson said that the company 'couldn't make the economics work with the lease cost.' These retail closures will not impact customers who use Amazon for grocery delivery.

On January 27, 2026, Amazon announced on its official blog that it will close all Amazon Go and Amazon Fresh physical stores. The closure affects a total of 72 stores—15 Amazon Go and 57 Amazon Fresh locations—with most ceasing operations on February 1. California stores will remain open longer to comply with state-mandated advance notice requirements.

Amazon explained the closures, stating that "we haven't yet built the unique customer experience and appropriate economic model needed for large-scale deployment in Amazon-branded physical stores." Some stores will be converted to Whole Foods Market locations.

Background and Industry Context

Amazon's physical grocery business began in earnest with the 2017 acquisition of Whole Foods Market ($13.7 billion). In 2018, the company opened Amazon Go checkout-free convenience stores to the public, followed by the launch of Amazon Fresh grocery stores in 2020. The "Just Walk Out" technology enabling checkout-free experiences attracted significant attention as a glimpse into retail's future.

However, according to CNBC reporting, Amazon had been closing some stores since around 2024, with a spokesperson at the time explaining that the company "couldn't make the economics work with the lease cost." The complete withdrawal announced now is an extension of that trend.

In the grocery retail industry, optimizing investment allocation between physical store operating costs and rapidly growing online grocery delivery services has become a key challenge. Grocery Dive analyzed Amazon's decision as "a return from experimental store formats to proven business models."

The New Three-Pillar Strategy—Whole Foods, Same-Day Delivery, and New Formats

In this announcement, Amazon revealed three focus areas for its new grocery business strategy.

Large-Scale Whole Foods Market Expansion

Since the 2017 acquisition, Whole Foods Market has achieved over 40% sales growth and currently operates more than 550 stores. Amazon plans to open "over 100" additional new stores. Additionally, the smaller format "Whole Foods Market Daily Shop" will add 5 stores by the end of 2026, expanding to a total of 10 locations.

Same-Day Delivery Service Enhancement

According to Amazon's official announcement, the company currently offers grocery delivery services in over 5,000 U.S. cities and towns, with further expansion planned during 2026. Notably, fresh food sales in same-day delivery services have "grown 40x since January 2025." Customers who order fresh food shop approximately twice as frequently as those who don't.

New Physical Store Format Development

Amazon is not completely abandoning physical retail. The company is developing a "new supercenter" store concept that will carry a wide range of fresh food, daily necessities, and general merchandise. Testing is also underway for "Amazon Now," which provides ultra-fast delivery within 30 minutes.

The Future of Just Walk Out Technology

The "Just Walk Out" checkout-free technology developed at Amazon Go will disappear from Amazon's own stores but will continue expanding as a third-party licensing business.

According to Chain Store Age, Just Walk Out technology is currently deployed in over 360 third-party locations across five countries: the United States, United Kingdom, Australia, Canada, and France. Amazon's Anthony Leggett stated that "of the 300+ deployments, 150 were added this year, and this growth has positioned us for further expansion in 2026 and beyond."

Deployment costs have decreased by over 50% in the past 18 months, with adoption progressing in sports stadiums, universities, and healthcare facilities. Seattle's Lumen Field has reported a 47% increase in per-game sales, while UC San Diego has seen an 83% reduction in shoplifting.

Additionally, Amazon announced RFID-enabled checkout lane technology for festivals and pop-up shops. This technology, which can be set up in just a few hours, is scheduled for deployment at 2026 concert tours and similar events.

Implications for E-Commerce Businesses

Amazon's strategic pivot contains important insights for e-commerce operators.

Prioritizing Delivery Infrastructure Investment

Amazon's decision to focus on same-day delivery over physical stores demonstrates the importance of "delivery as customer touchpoint." Data showing that customers who purchase fresh food via delivery shop twice as frequently suggests that delivery experience quality directly impacts customer loyalty.

The Harsh Economics of Physical Retail

Even Amazon, with its cutting-edge technology capabilities, couldn't make physical store economics work. E-commerce businesses considering physical retail expansion need to carefully evaluate lease costs, labor costs, and inventory management expenses.

Technology Licensing Model

Just Walk Out technology's third-party deployment demonstrates the effectiveness of earning licensing fees rather than operating stores directly. For e-commerce businesses with retail technology, providing technology as a service is worth considering.

Summary

Amazon's decision provides a clear answer to the "physical stores vs. online" question in grocery retail. The 40x growth rate in fresh food sales via same-day delivery is proof that customers prioritize convenience.

That said, the plans for over 100 new Whole Foods Market stores and the new supercenter concept show that Amazon hasn't completely abandoned physical retail. The key point is "what format of physical store"—the search for formats that can balance uniqueness and economic viability continues.

E-commerce businesses should watch for the same-day delivery area expansion planned for 2026 and details of the new supercenter concept. Amazon's next move in grocery strategy could determine the direction of the entire industry.

Related Articles

Amazon Announces Walmart-Style Supercenter Plans: Building 220,000 Sq Ft Store in Chicago Suburb

Amazon submits plans for 229,000 sq ft big-box store in Orland Park, Illinois - larger than Walmart Supercenter average, selling groceries and general merchandise.

Amazon vs Walmart: Contrasting Strategies in Agentic Commerce

Walmart adopts Google UCP and promotes open standards. Amazon maintains proprietary systems with a closed approach. How these choices will shape the market's future.

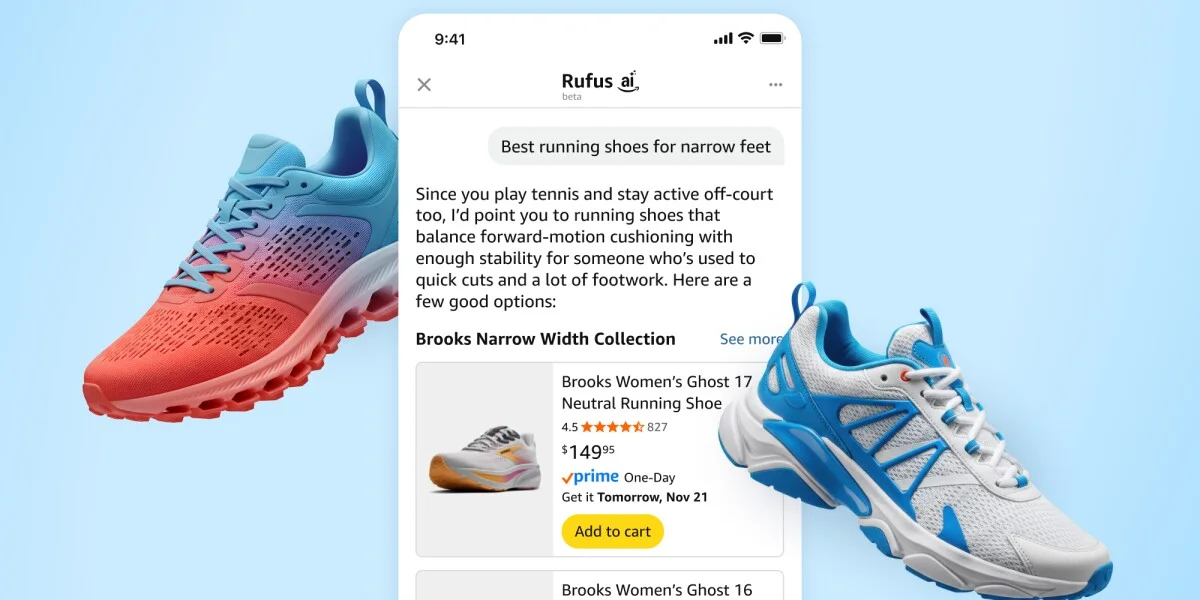

Amazon Rufus: The Full Picture of the AI Shopping Assistant Used by 250 Million People

Amazon Rufus reaches 250 million users and drives $10 billion in additional sales. Deep dive into its technology, features, and implications for e-commerce.